Arizona Investment Fraud Lawyer

Arizona Investment Fraud Attorney

Investment losses are common in the financial world, and many individual investors come to expect them in today’s volatile market. However, there are some instances in which your trusted broker or investment advisor may be acting fraudulently or negligently when it comes to your investments, and you might suffer losses that could have been avoided. In these situations, the legal support and guidance of an Arizona investment fraud lawyer can help you recover.

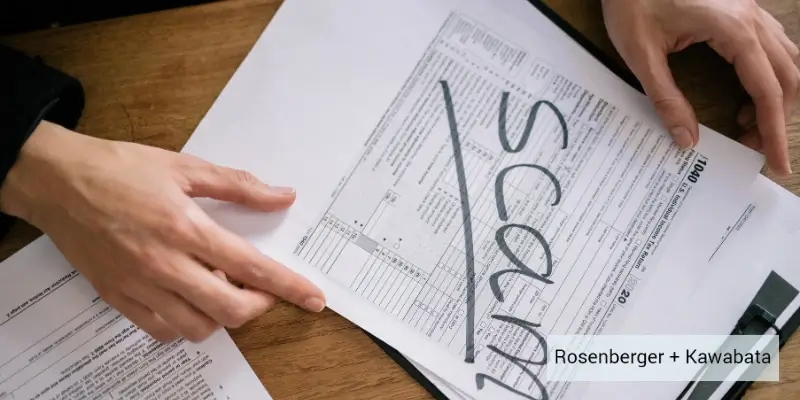

The promise of low-risk, high-reward investments can be attractive, especially to individuals just starting out on their investment journey. Unfortunately, in many cases, these attractive offers are actually a way in which investment professionals lure in victims for fraud, making investment moves that line their own pockets and cause damages to be suffered by the individual investors. Thankfully, help is available, and the attorneys at Rosenberger + Kawabata are here for you.

Common Types of Investment or Securities Fraud in Arizona

Investment fraud, otherwise known as securities fraud, is a planned deception or scheme made by an individual broker-deal, an investment advisor, or a brokerage firm that robs investors of their money with the promises of high return. Often, instead of promised high returns, investors find themselves victims of extensive financial losses while investment advisors, brokers, or firms reap the benefits of high commissions.

There are several ways in which this fraud can take place, and it is wise to hire an attorney who can review the unique circumstances of your case to identify what kind of fraud you have been the victim of in order to assist in recovering your losses. The most common types of investment or securities fraud in Arizona can include the following scenarios:

- Breach of Fiduciary Duty: Investors who hire broker-dealers are owed a duty by these financial professionals. The law requires these individuals to recommend the sales and purchases of securities only if those transactions are in the interests of the investor and are suited to the investor’s financial goals. When an adviser engages in unethical behaviors, they are liable for breach of fiduciary duty.

- Failure to Diversify: Investment advisors and broker-dealers are required to make smart investment recommendations to investors based on the investor’s age, risk tolerance, financial stability, and their investment desires. In order to act in the interests of their clients, brokers are required to diversify the portfolios of their clients. Failing to do so can result in the risk of loss for the investor.

- Failure to Supervise: Brokerage firms are required to supervise the activities of their registered employees, to protect their investors. However, when a broker violates securities law and engages in unethical behaviors such as unauthorized trading, the law dictates that the firm has failed their duty and could be held responsible for any losses that were suffered as a result.

- Unauthorized Trading: When a broker or investment advisor ignores the wishes and directions of their investor when making trades, they can be held accountable for any losses the investor’s financials suffer. Unauthorized trading is an unethical and unlawful practice and can be punished if the investment advisor or broker is found to be guilty of such actions.

- Selling Away: In Arizona, it is illegal for a broker or investment advisor to transact any securities which are not offered by the firm where they are registered as an employee or have not received the approval by written notice. Firms are required to prevent this kind of behavior and if they have failed to supervise their employee who has engaged in any kind of selling away action, they can be held liable for any losses which incurred.

- Churning: Otherwise known as excessive trading, churning can take place when an investment advisor or broker engages in the excessive buying or selling of a security in a client’s portfolio without considering the financial goals of their client. This is to generate high commissions for the broker themselves. Unfortunately, these individuals typically come up with reasonable explanations for their actions, leading to events of fraud.

- Broker Theft: Brokers and investment advisers can engage in schemes to steal the money of their client. This can happen in a number of ways, including redirecting the investor’s money into a fake account or convincing investors to sign promissory notes that they insist are backed by collateral. They may even make up investment opportunities in order to line their own pockets. Both firms and the individual broker can be held liable in these cases.

- Ponzi Schemes: A Ponzi scheme is an illegal practice where an investment advisor or broker-dealer can get their investors involved in what seems to be a very low-risk, high-reward situation. In a Ponzi scheme, you may see these rewards rather quickly, but unfortunately, your investment funds are actually only being used to pay the investors who came before you.

- Elder Abuse: Senior individuals who have large assets or investments can be attractive to unethical brokers or investment advisors as they might not fully understand the scope of their investments. If you believe your senior loved one has been the victim of investment fraud, you need to contact the attorneys at Rosenberger + Kawabata right away so the potential damage may be mitigated.

If you believe that you have been the victim of any of these examples of investment or securities fraud in Arizona, it is time to consult the attorneys at Rosenberger + Kawabata. We understand that these can be frightening and uncertain times and hope to do everything in our power to help you recover the losses you have been made to suffer.

How the Attorneys at Rosenberger + Kawabata Can Help You Recover Financial Losses

Our skilled legal team is passionate about working to help our clients recover losses suffered due to negligent or unethical investment advisors, broker-dealers, or brokerage firms. We know how these professionals and corporations tick and can work diligently to hold them accountable for the financial hardships they have put you through.

When you hire the attorneys from the offices of Rosenberger + Kawabata, you can rest assured knowing you have the right people in your corner. From the first consultation, we can begin to review your case, evaluate its validity, and begin to gather evidence to back up your claim of fraud. We can then enter into negotiations with the parties involved after determining liability, and if negotiations do not result in a fair settlement offer, bring your claim to court.

With Rosenberger + Kawabata at your side, you can have the confidence knowing there is someone on your side, fighting for the protection of your legal and financial rights that has proven results holding other fraudulent parties accountable.

Top-Tier, Forward-Thinking Advocacy It’s what we do all day, every day.

Red Flags of Investment Fraud in Arizona

There are several warning signs that can point to investment fraud in Arizona. Even if you have already discovered you are the victim of this sort of financial deception, knowing these signs can keep you from making a similar mistake in the future and can help educate your friends and family members in order to keep them from making the same misstep. The most common red flags of securities or investment fraud include the following:

- Being pressured into sales or investments that you do not feel comfortable making

- Being promised little to no risk, especially in cases of alleged “high-reward” investments

- Suffering difficulty when trying to cash out investments

- Your advisor or broker lacks professional licenses or certifications

- Your broker or advisor is avoiding your questions or requests for communication or documentation

- Being promised unrealistic guarantees of significant returns over a short period of time

- Your broker or advisor being difficult to get in contact with

How Do You Prove Investment Fraud?

In order to prove that you are the victim of investment fraud, there are several things you will need to demonstrate are true. First, you will need to show that the financial professional you trusted intentionally or negligently misrepresented or omitted facts about your investments. You will also need to show you relied on this incorrect information when the investment was made and that the damages you suffered were a direct result of the misinformation.

What to Do If You Are the Victim of Investment Fraud

If you believe you are a victim of investment fraud, you should document everything you have as it pertains to the instance of supposed fraud. This includes any account statements or communications with your broker, investment advisor, or brokerage firm. Then, you will want to contact an experienced attorney with the knowledge to assist you in filing a claim for compensation against the fraudulent individual or corporation.

Rosenberger + Kawabata: Protecting Your Legal Rights in Investment Fraud Cases

If you suspect that you are the victim of investment or securities fraud in Arizona, the dedicated team at Rosenberger + Kawabata is here to fight for you and protect your legal rights. These cases can be difficult and complex legal matters, but we are here to help. Contact our law office today to learn more about how we can be of service to you.